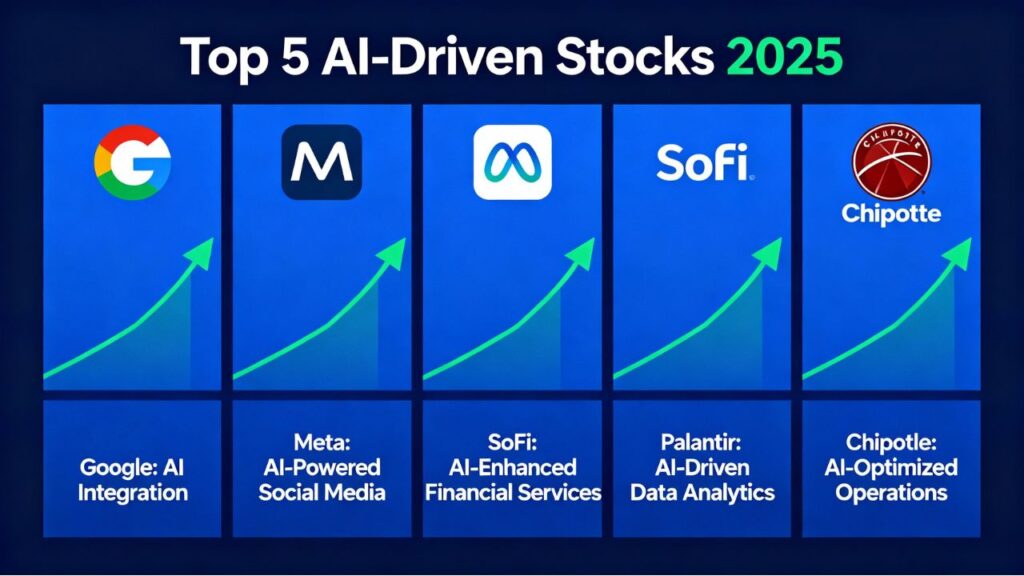

In 2025, the stock market has entered into a new phase — where AI, automation and digital ecosystems are creating long-term winners. This year, there are some companies that are standing out not just on the strength of fundamentals, but also because of their future positioning. In this article, we are personally going to see the best 5 stocks because they are perfect not just for short-term trading but also for long-term wealth creation. Let’s start with deep analysis.👇

1️⃣ Google (Alphabet Inc.) – Growth Engine with AI

Currently, the market cap of Alphabet Inc. (GOOGLE) has of around $3.39 trillion , and we are very confident that it could cross the valuation of $4 trillion by the end of 2025.

Why Google Is Still Undervalued:

- Search Dominance: Google has created nearly a monopoly on search market share. Chrome browsers and Android devices, the combination of these two, has made the company’s ecosystem unbeatable.

- Ecosystem Lock-In: Google default search engine is everywhere even on the Safari and Apple devices — creates behavioral pattern that locks-in the users.

- AI Integration: The features like Google AI Overview redefine the users experience — increases the search engagement by providing the instant, smart and context-based answers.

- Valuation Metrics: Trailing PE 26 and forward PE 23 strong numbers, especially in the context of AI-driven future earning.

- Data Moat: It have real-world behavioral data that is collected from the billions of daily search is the goldmines for many Google’s models.

📈 Prediction: With the next 6 months, $330 per share clear target. This is a ideal long-term stock for a risk-low and reward-high scenario.

2️⃣ Meta Platforms (META) – AI Infrastructure Powerhouse

Meta platforms stock has corrected from $750 se $650, but this correction could be an opportunity for the long-term investors.

Why I’m Bullish on Meta:

- Temporary Headwinds: Margin have come under pressure by a $16B’s one-time tax and infrastructure cost spikes, but the infrastructural story remain intact.

- From Social to AI Infrastructure: Meta is not just only Facebook or Instagram — it’s becoming a AI-driven backbone , where Meta Llama 3 and future LLMs will dominate.

- Platform Strength:

- Instagram + Reels: AI-personalized feed has broken the all engagement records.

- Facebook: Aging audience = higher ad-spend demographic.

- WhatsApp Business: AI agents and smart ads becoming the new revenue engine.

- Financial Stability: $20B+ quarterly free cash flow making Meta the “AI era’s most profitable infrastructure company”.

💡 Verdict: Meta is a compounding story — short-term dips are simple buying opportunities.

3️⃣ SoFi Technologies (SOFI) – Fintech’s King of Ecosystem

SoFi fintech is becoming the world’s first silent compounding machine. A 12% jump in one month is just the beginning.

Why SoFi Is Future-Ready:

- Ecosystem Lock-In: Loans, credit cards, investing — all at just one platform. Customers rarely exit once they enter SoFi’s ecosystem.

- Cross-Selling Power: Here every account become a revenue funnel— retention and monetization both are high.

- Financial Growth: Revenue, users and deposits — double-digit growth in all these three.

- Valuation Potential: Sign of $100B potential against the current $10B market cap are very clear.

💰 Personal Note: Many top investors are invested in this, and they have already seen a 35% gain. By 2026, the $50 target stock seems to be quite realistic.

4️⃣ Palantir (PLTR) – AI Data Analytics’s Legend

Palantir has started writing a new major civilian AI story from his government and Defense sector roots.

Why Palantir Stands Out:

- Earnings Breakout: Recent reports solidify the investor confidence, and the result is 10% stock jump.

- High PE Justified: PE ratio 200+ looks little scary, but growth trajectory seems to be similar to the early phases of Tesla/Amazon.

- Contract Moat: US Government and NATO-level defense contracts provides Palantir a recurring, secure revenue.

- Profitability Shift: After the years of R&D, now the company has entered into the cash-positive and profit-sustainable phase.

💼 Investor Insight: Palantir shares is good to be hold, because it generates a passive income from covered call strategy.

5️⃣ Chipotle (CMG) – The Next McDonald’s? 🌮

Chipotle is a restaurant stock and like every long-term investor should have in their portfolio.

Why Chipotle Is Special:

- Global Expansion: From the 3,800 stores, now the management is targeting to jump 7,000 stores globally.

- New Markets: Canada, Europe, Kuwait and South Korea are growing with very rapid expansion.

- Tech & Automation: With the Robotic kitchens and AI-based scheduling, efficiency is going to increase at a record levels.

- McDonald’s-Style Scaling: As Chipotle grows, they shift the model from “fresh food fast” to “fast food fresh” model — higher profits, better margins.

📊 Long View: steady compounding is a perfect restaurant play with the brand maturity like McDonald’s.

💬 Final Thoughts

If your goal is sustainable wealth creation by the end of 2025-2023, then these 5 stocks can make an ideal balanced portfolio.

- Google – Stability & AI dominance

- Meta – Next-gen infrastructure growth

- SoFi – Fintech super app revolution

- Palantir – Data intelligence leadership

- Chipotle – Global expansion & profit scalability