When the market become volatile and VIX spike then those moments become the golden period for the options sellers. Now still VIX score is around is 19, which means premium is still high. This is the phase where you generates a steady income and acquire high value stocks like SoFi at the discounted price.

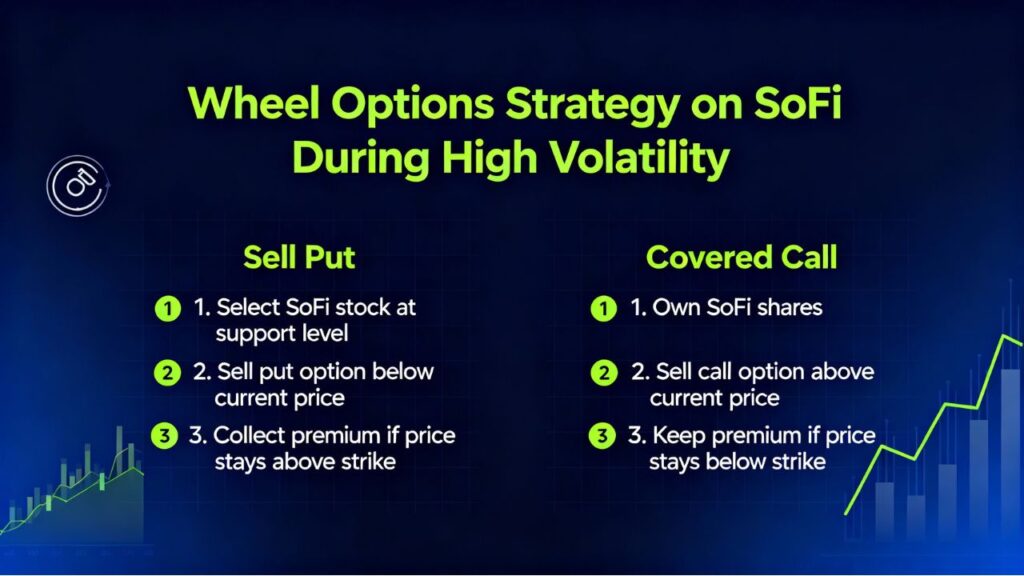

If you are likely a beginner or a intermediate level option trader then these two practical setup is most important for you:

(1) Sell Put and

(2) Covered Call (essential part of wheel strategy).

This trades are not just short-term strategy but also a long-term wealth-building tools. The most impotant thing is this is not a financial advice — just a educational insight which helps you to get more understanding about the option market.

Why SoFi? Business Moat and Flywheel

SoFi is trying to create a fintech ecosystem, where the main focus is not just selling its product but also on the customer retention. Generally this business model work like a flywheel— where once customer enters through student loans, and they gets the smooth experience and after that the same customer later also uses mortgage, credit card, investments, or savings products. Each and every satisfied users generates the future revenue stream. And this network effect and cross-sell structure make SoFi unique.

For now, the stock are currently in the pullback phase, but with a solid fundamental growth— with positive revenue trajectory, deposits are at record level and profitability is clearly at upside direction. That’s why investing in SoFi through options— safe entry + consistent income.

Market Context: Volatility is Your Friend (If You Know Options)

When VIX is around~19, it means market is fear elevated, and when the fear is high, then the options premium also swell. Often the new traders thinks that high volatility is a bad thing but ask the experienced options players because they knows that this is a golden opportunity time. High implied volatility (IV) means you’re getting paid more per contract for taking on the same obligation. If you want a fundamentally robust stock like SoFi, then the most efficient entry strategy is to sell put and writes call during high-IV phase. This approach gives you the two best benefits— time decay income and discounted stock entry.

Trade 1 – Sell Put (Monthly Strategy)

Concept: When do you sell the put, in that case you are promising to buy the stock if it drop below the certain strike price. You will get the premium upfront and if the stock remain stable, then you pocket that premium as a pure income.

Example Setup (Practical):

- SoFi current price: $28.40

- Strike: $27 (monthly expiration)

- Delta: approx. 0.37 (37% chance stock below strike at expiry)

- IV: around 71 (high volatility = juicy premiums)

- Premium received: ~ $166 per contract

Outcome Possibilities:

- Stock above $27: Here you keep the entire premium (~7% return in 30 days, annualized >80%).

- Stock below $27: Here you get assigned, but effectively buy SoFi at discounted cost (around $25.34 after premium).

Why this is smart:

- Here you get the high-quality stock at cheaper price.

- If not assigned, steady income like dividend received.

- Short time horizon which also means frequent income cycles.

Risks:

Market crash or sharp correction could be result in paper losses so that’s why capital reserve is most important. Puts should be always cash-backed, and don’t be over-leverage on margin.

Trade 2 – Covered Call (Wheel Strategy Continuation)

Concept: If you already have the stock then you can earn the monthly premium by selling the call on it. Here you can limit the upside but also can generate the steady cash flow.

Example Setup:

- Hold 100 SoFi shares (average $28.40)

- Sell 1-month 31 strike call

- Premium: ~$131 per contract

Outcomes:

- Stock below $31: Here you keep premium, shares stay with you.

- Stock above $31: Here you sell at $31, earning profit on appreciation + premium income.

Why this works:

- Here you get the instant income even if stock doesn’t move.

- With the high IV also ensures the strong premiums.

- You can repeat this monthly, essentially renting out your shares for income.

This is generally the next step of the wheel strategy— first buy share a low price by selling puts and after that create a steady cash flow by selling call on those shares.

Technical Confirmation: Bollinger Bands, Moving Averages & Volume

We generally use the technical indicator to confirm the trading decisions. At present, SoFi is at the mid-zone of Bollinger Bands, the more closer it move towards the support, the more confident the option seller will become. Volume is also bit critical — 27 strike put and 31 strike call both liquid options (400+ contracts), means the execution will be smoother. The combination of Delta and IV gives you a practical risk-reward balance— with not more aggressive, and not more conservative.

Position Sizing, Hedging & Risk Discipline

Position sizing is a lifeline for each and every serious traders. You must try to execute the both Puts and Calls with the limited capital exposure— whether it is 2–5% of your portfolio. The covered call is itself a natural hedge but if you have the fear of market crash then you can cover the downside further by buying the protective puts. You can set a realistic goals— monthly 6–8% return on risk capital is possible, but this is a high variance strategy. When the volatility collapse, gets less premium and patience become important. Here you need to focus on trade consistency — not jackpot trades. Also remember that options have different tax treatment (short-term gain nature) and brokers margin rule also vary. You need to always check your platform’s buying power impact before trading.

Final Thoughts: Long-Term Wealth Through Smart Options

This is why the wheel strategy become the perfect blend for the conservative income seekers:

- Put selling: With the discounted entry + income.

- Covered calls: With the regular cashflow + time decay profit.

- Volatility: With the high premium environment = maximum efficiency.

- Underlying (SoFi): With the strong fundamentals + scalable business model + growing customer ecosystem.

If you execute each and every trade with patience and discipline, then you will be able to create a steady passive cashflow by systematically building stocks like SoFi.